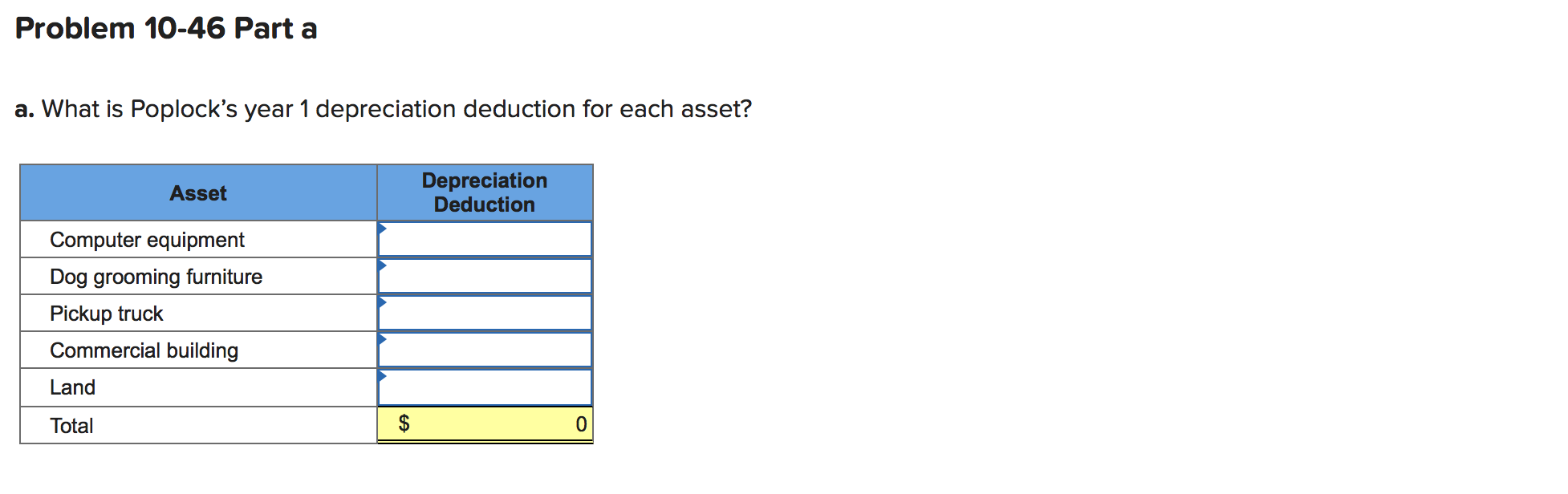

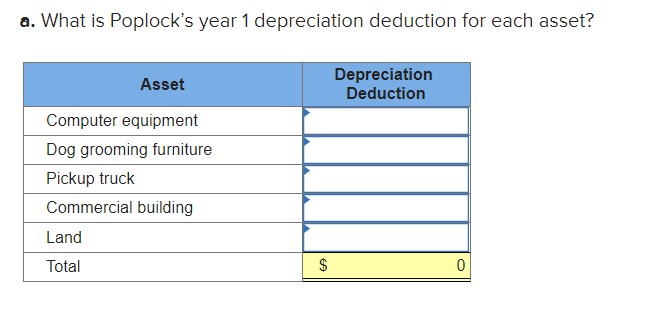

What Is Poplocks Year 1 Depreciation Deduction for Each Asset

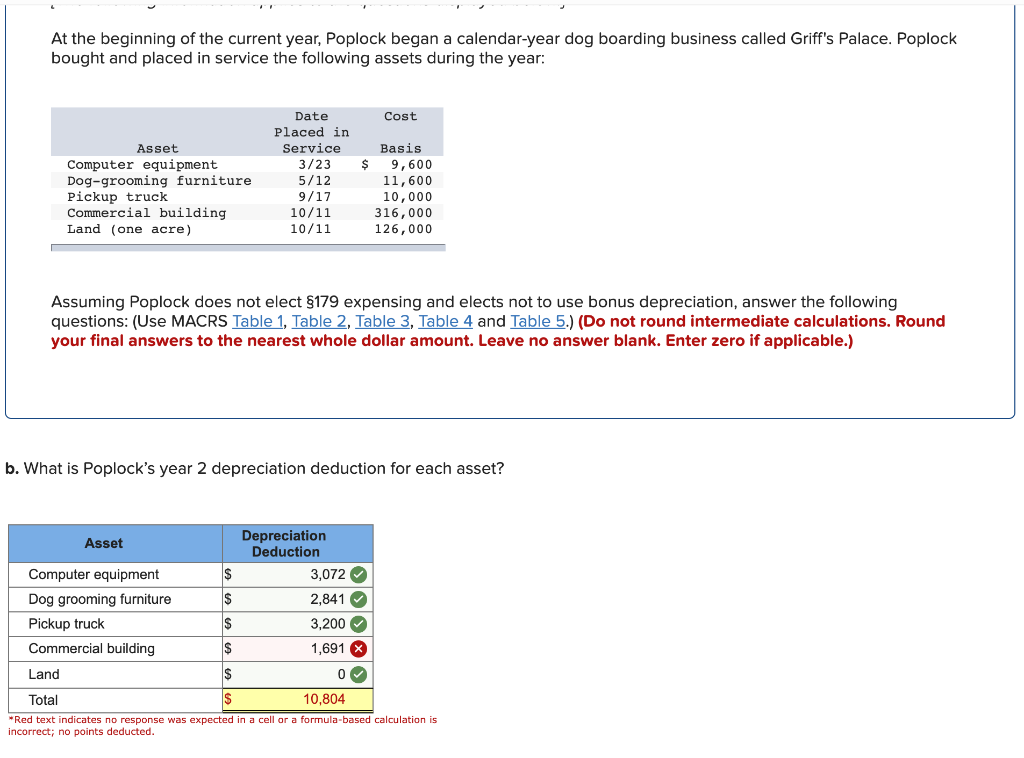

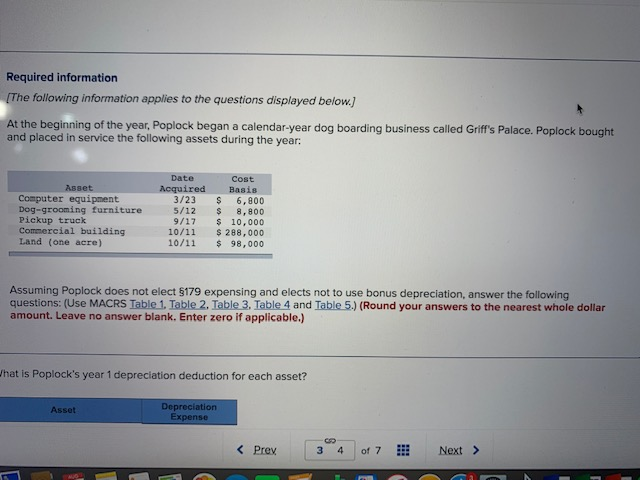

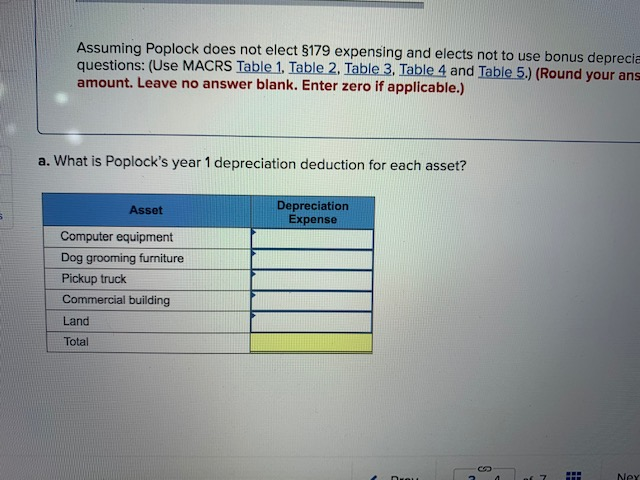

Course Title ACCT 4311. Depreciation Expense Asset Computer equipment Dog grooming furniture Pickup truck Commercial building Land Total.

Solved At The Beginning Of The Current Year Poplock Began A Chegg Com

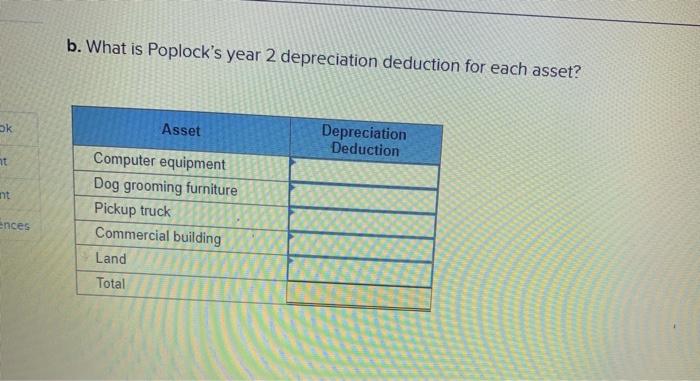

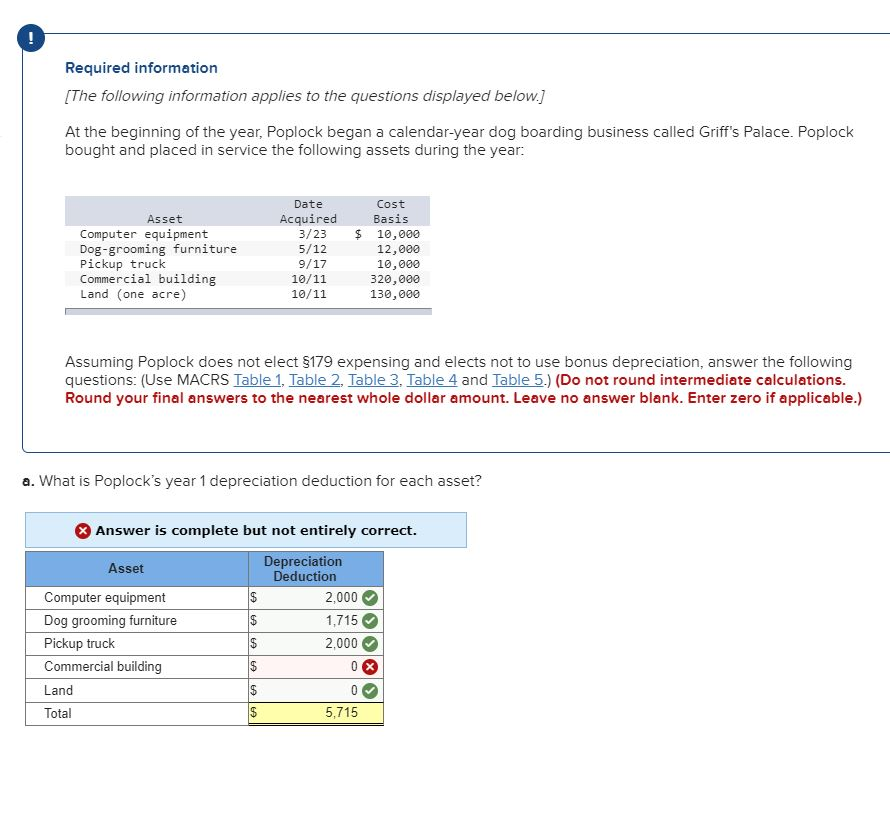

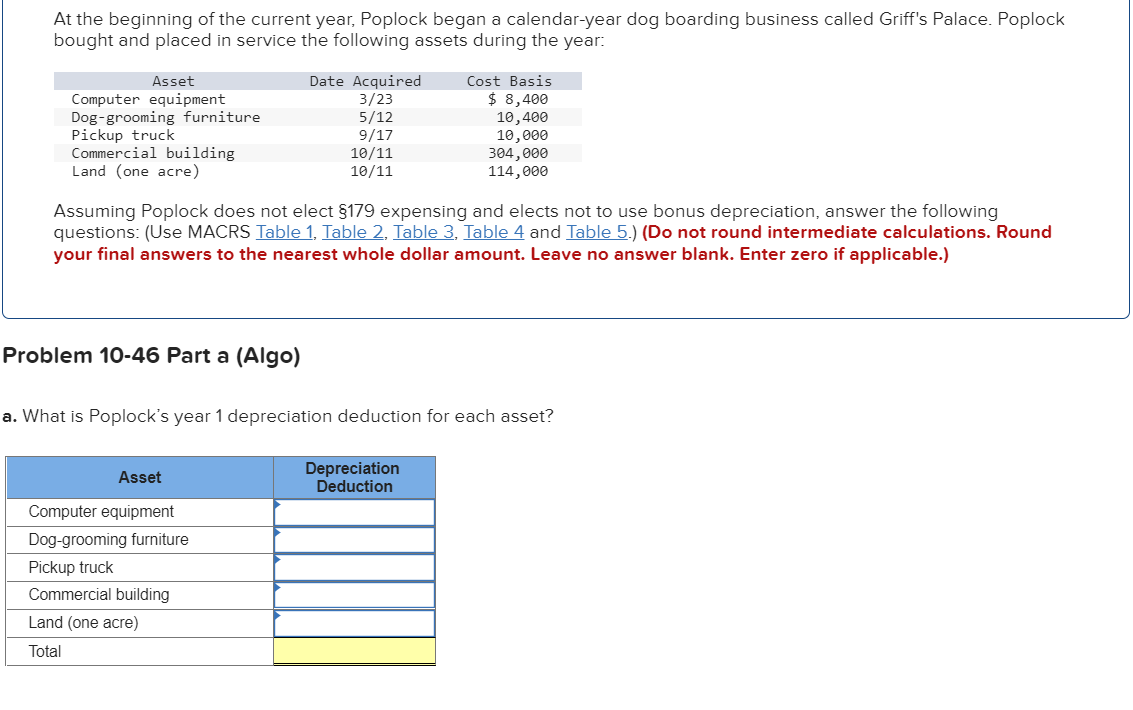

What is Poplocks year 1 depreciation deduction for each asset.

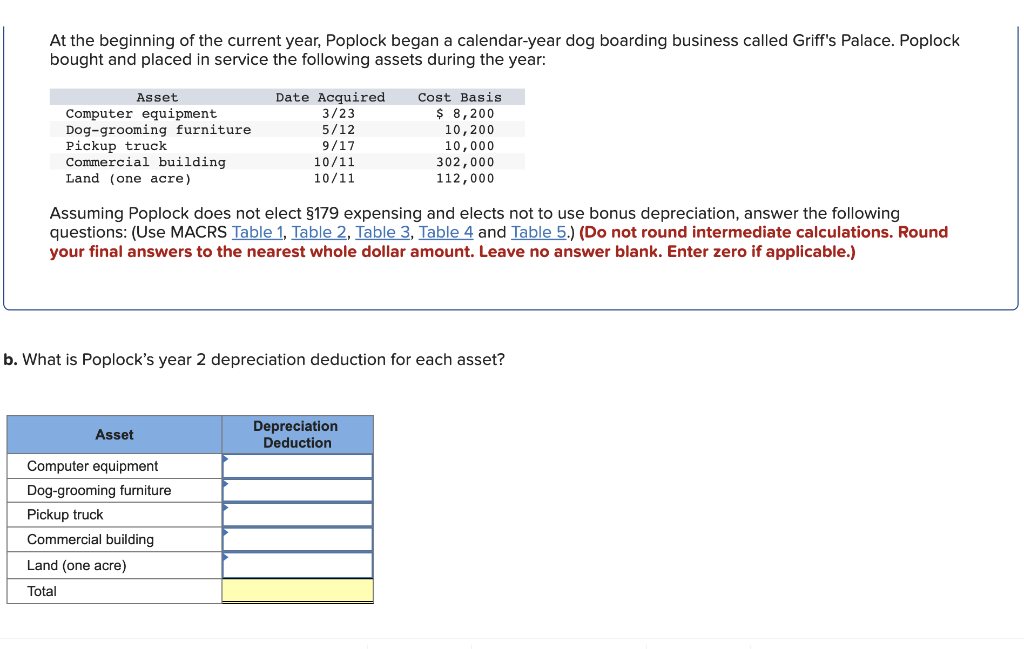

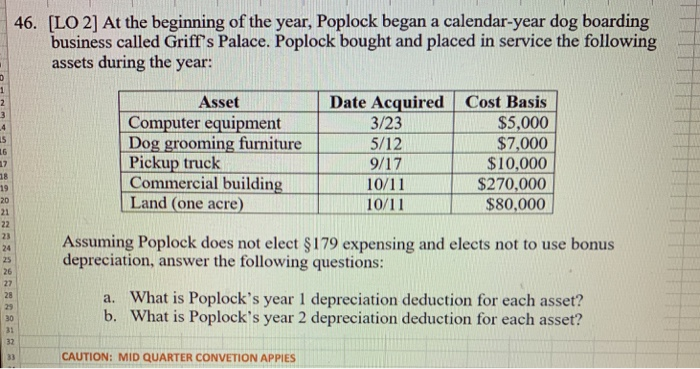

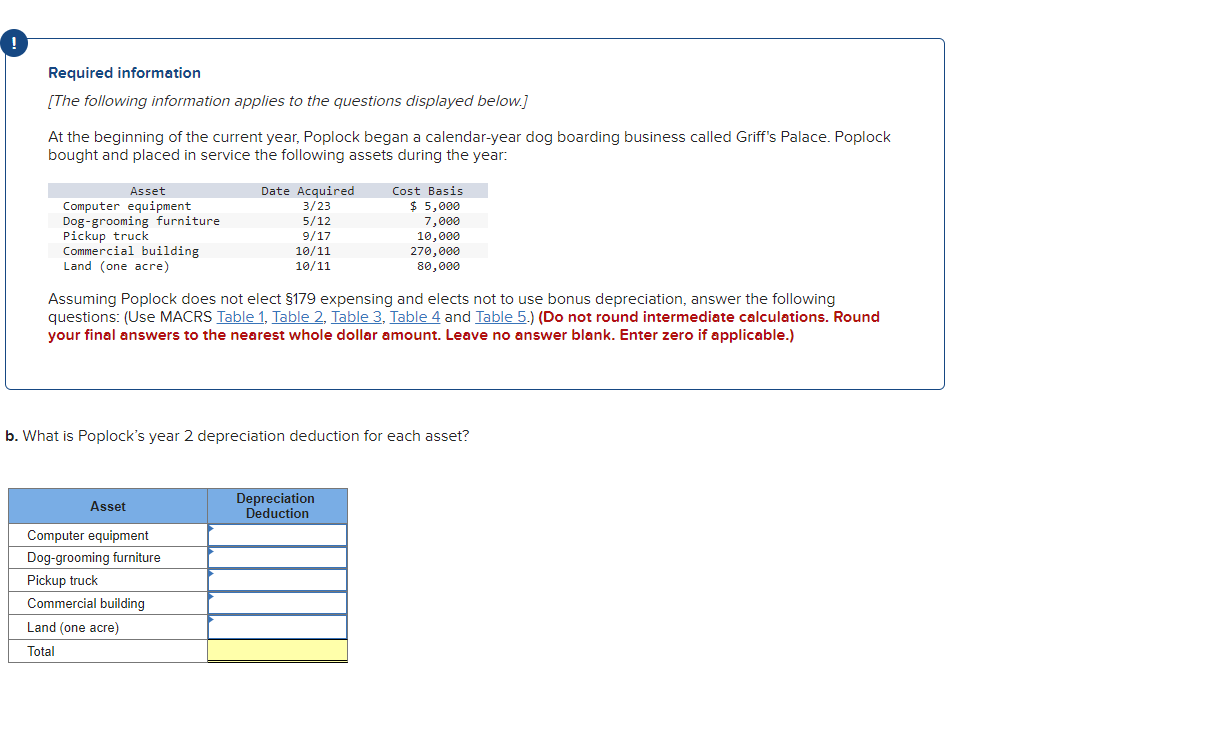

. B what is poplocks year 2 depreciation expense for. At the beginning of the year Poplock began a calendar-year dog. Use MACRS Table 1 Table 2.

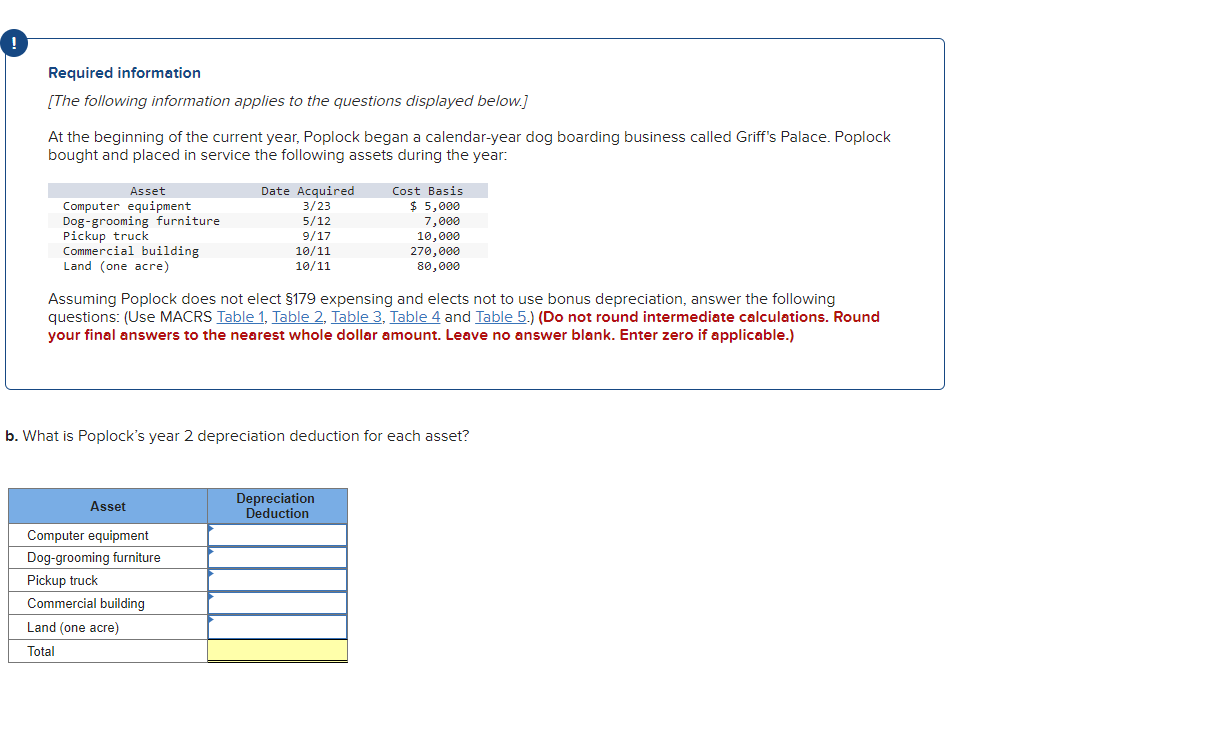

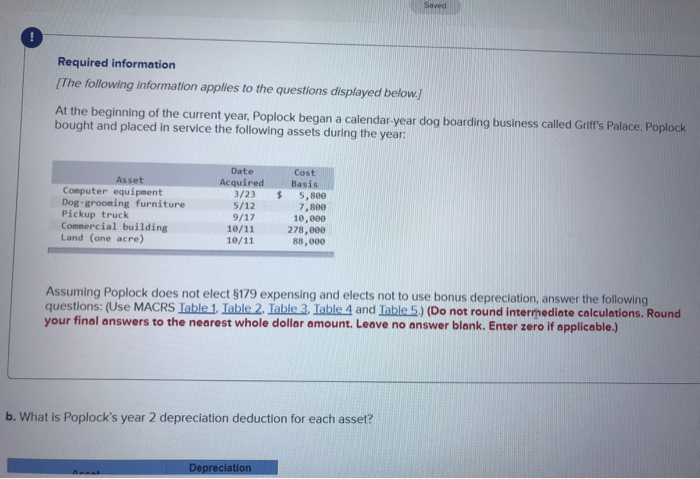

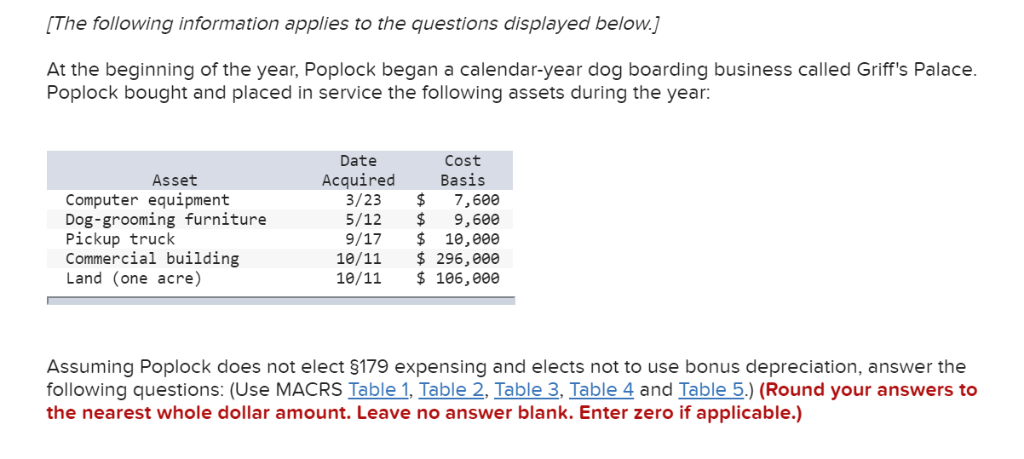

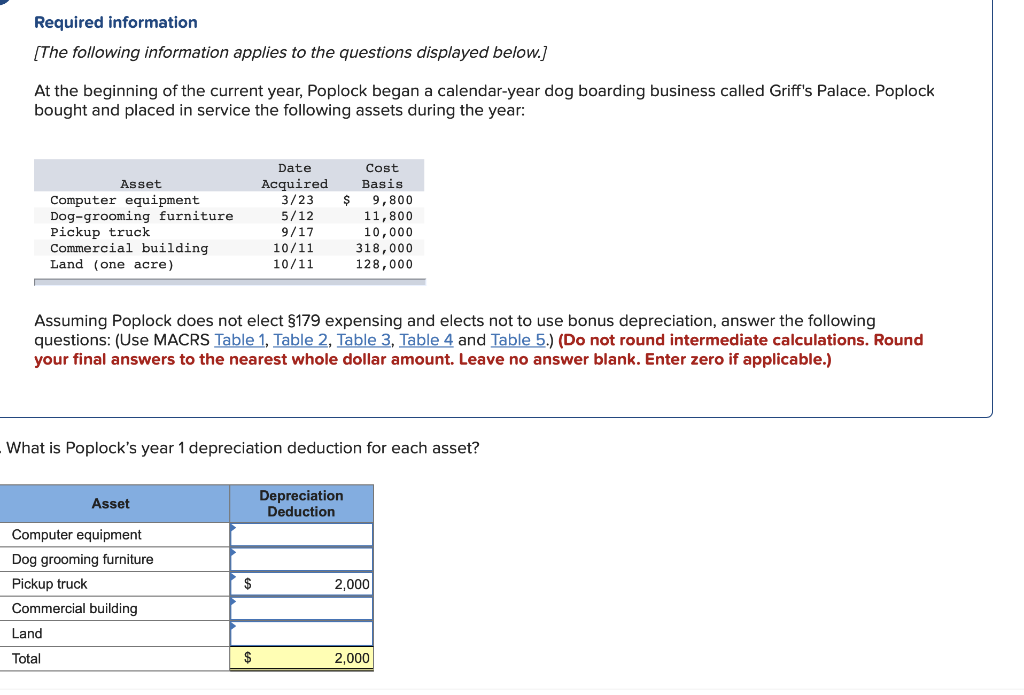

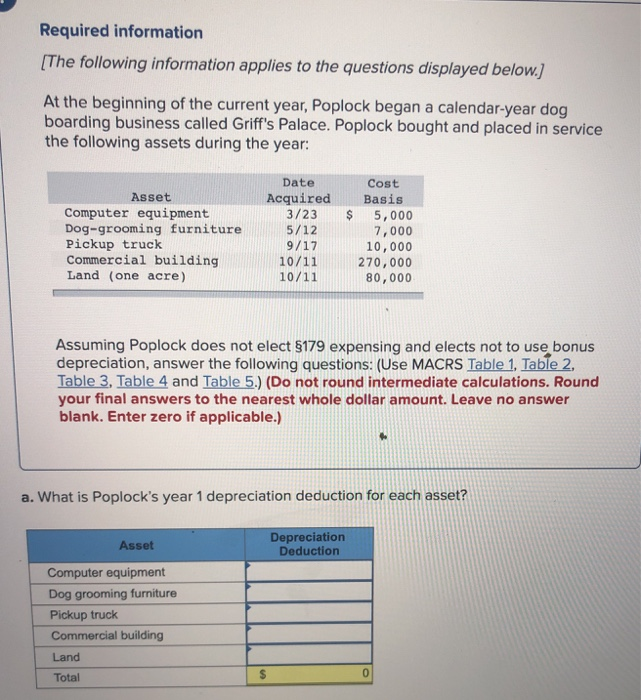

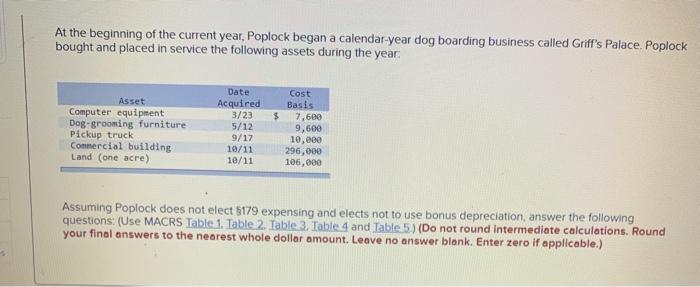

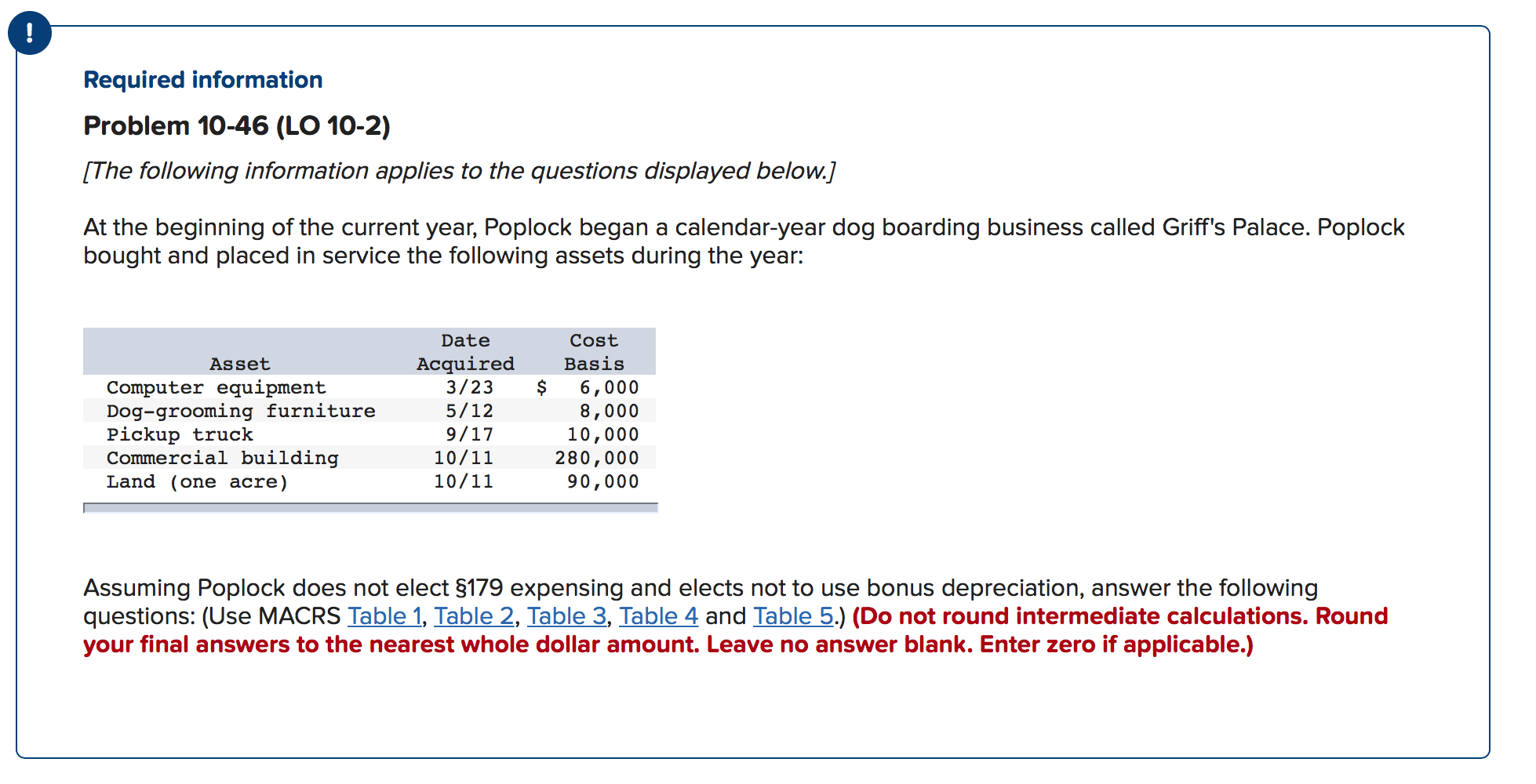

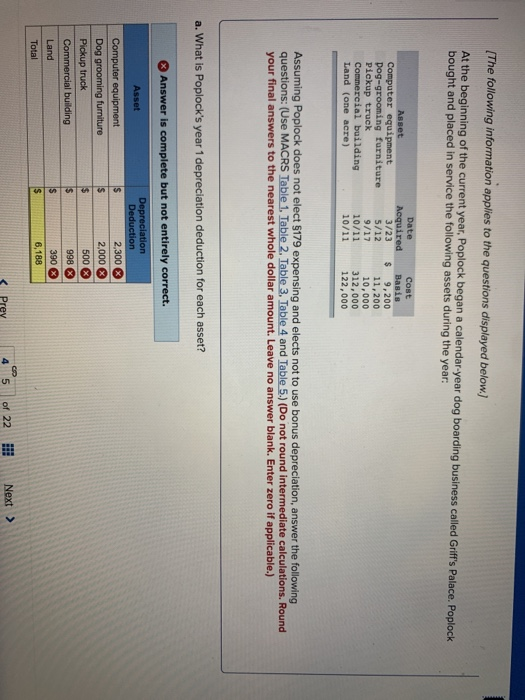

Poplock bought and placed in service the following assets during the year Date Cost Basis Asset Acquired Computer equipment Dog-grooming furniture Pickup truck Commercial. What is Poplocks year 1 depreciation expense for each asset. So this problem is asking us to find the depreciation equation for this laptop that was purchased by a small business.

1 Purchase Date Quarter Recovery period Original Basis 2 Rate 1 x 2 Depreciation Asset Computer equipment 23 - Mar 1 st 5 years 5000 2000 1000 Dog grooming furniture 12 - May 2 nd 7 years 7000 1429 1000 Pickup truck 17 - Sep 3 rd 5. Assuming Poplock does not elect 179 expensing and elects not to use bonus depreciation answer the following questions. What is poplocks year 1 depreciation deduction for each Assignment Help Financial Management.

Palace poplock bought and placed in service the. At the beginning of the current year Poplock began a calendar-year dog boarding business called Griffs Palace. Land is not depreciable.

B What is Poplocks year 2 depreciation deduction for each asset Asset from ACCT 481 at Columbia College. The following information applies to the questions displayed below At the beginning of the year Poplock began a calendar-year dog boarding business called Griffs Palace. So when the laptop was first purchased its value was 2700.

Course Title ACCT No results. Do you need a similar assignment done for you from scratch. Choosing to use the 179 immediate expensing option on the seven-year property results in accelerated depreciation compared to choosing the five-year property.

Palace Poplock bought and placed in service the following assets during the year. Dont use plagiarized sources. If the salvage value of the asset was estimated to be zero.

LO 9- Assuming Poplock does not elect 179 expensing and elects not to use bonus depreciation answer the following questions. At the beginning of the year Poplock began a calendar-year dog boarding business called Griffs Palace. Poplock bought and placed in service the following assets during the year.

Now we can use these numbers to make coordinates. Poplock bought and placed in. At the beginning of the year Poplock began a calendar-year dog boarding business called Griffs Palace.

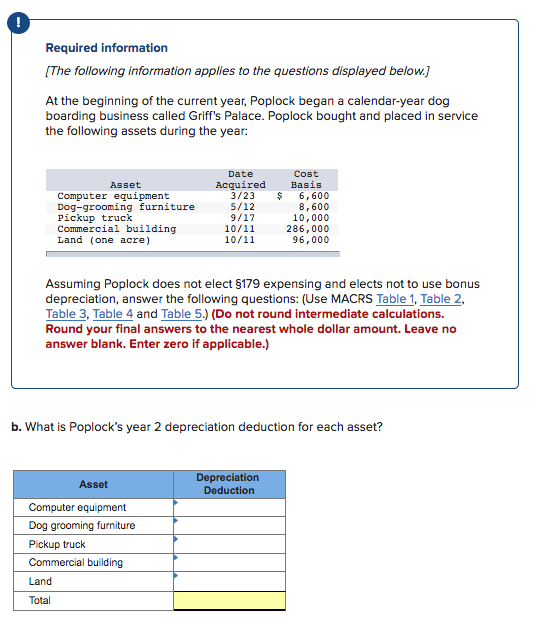

Date Cost Asset Acquired Basis Computer equipment 323 7200 Dog-grooming furniture 512 9200 Pickup truck 917 10000 Commercial building 1011 292000 Land one acre 1011 102000. What is the depreciation deduction using each of the following methods for the second year for an asset that costs 35000 and has an estimated MV of 7000 at the end of its seven-year useful life. Poplock bought and placed in service the.

Poplock bought and placed in service the following assets during the year. School University of Houston Victoria. Poplock bought and placed in service the following assets during the year.

At the beginning of the current year Poplock began a calendar-year dog boarding business called Griffs Palace. Solution for The depreciation deduction for year 11 of an asset with a 20-year useful life is 4000. In our example the double-declining balance percentage would be 20 so in the first year an asset purchased for 5000 would depreciate by 1000.

What is Poplocks year 1 depreciation deduction for each asset. Assuming Poplock does not elect 179 expensing and elects not to use bonus depreciation answer the following questions. To find the yearly depreciation amount using the double-declining method multiply the value of the asset at the beginning of the year by twice the straight line depreciation percentage.

A 200 DB b GDS MACRS and c ADS MACRS. Get Your Custom Essay on. Question - At the beginning of the year Poplock began a calendar-year dog boarding business called Griffs Palace.

LO 2 At the beginning of the year Poplock began a calendar-year dog boarding business called Griffs Palace. Upon ordering we do an original paper exclusively for you. Now in this chart I ever in the years versus the value of the laptop.

We do not resell papers. A What is Poplocks year 1 depreciation deduction for each. 5445 under the half-year convention for personal property calculated as follows.

The cost recovery for the equipment is 204000 1020000 020 resulting in a total depreciation deduction of 1224000 1020000 machinery 204000 computer equipment. We have qualified writers to help you. Pages 6 Ratings 96 45 43 out of 45 people found this document helpful.

Poplock bought and placed in service the following assets during the year. 1000 1000 2000 1445 0 a. Pages 2 This preview shows page 1 - 2 out of 2 pages.

View the full answer. The maximum depreciation deduction is 637300. Assuming Poplock does not elect 179 expensing or bonus depreciation answer the following questions.

Assume its MACRS class life is also seven years. Purchase Recovery 1 Original 2 1 2 Asset Date Quarter Period Basis Rate Depreciation Computer equipment 23-Mar 1st 5 years 5000 2000 1000 Dog grooming furniture 12-May 2nd 7 years 7000 1429 1000 Pickup truck 17-Sep 3rd 5 years 10000 2000 2000. What is Poplocks year 1 depreciation deduction for each asset.

Solution for What is the depreciation deduction each year using each of the methods below for an asset that costs 65000 and has an estimated salvage value. What is Poplock depreciation deduction for each asset Answered. School University of Houston Victoria.

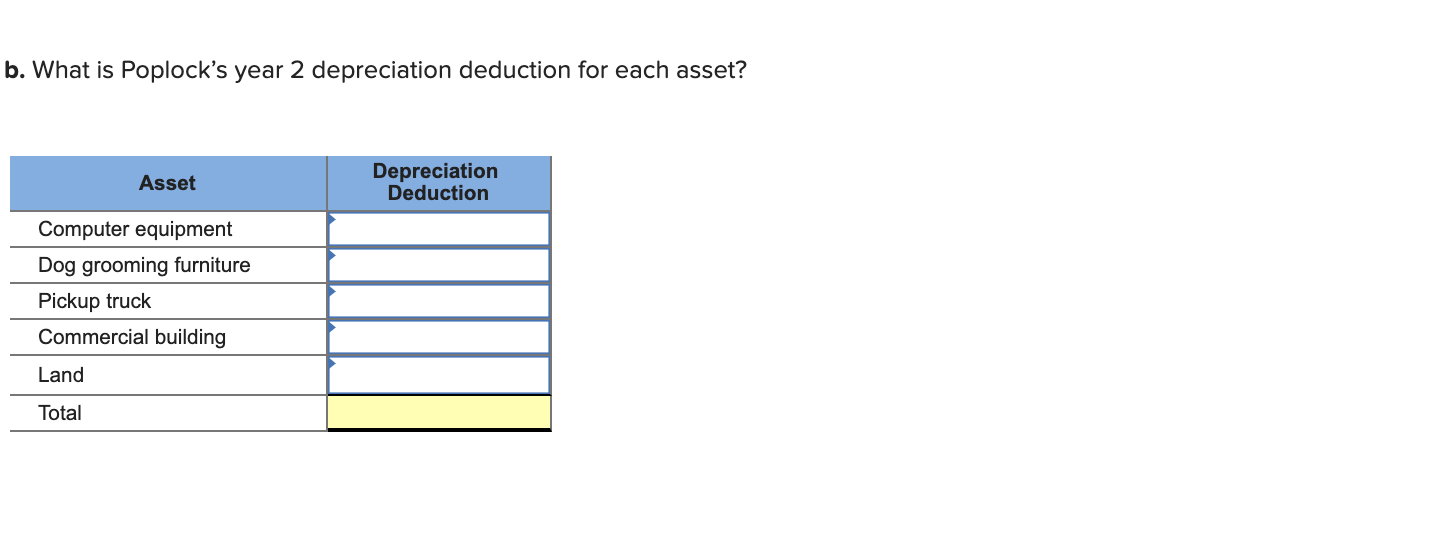

B What is Poplocks year 2 depreciation expense for each asset a 5445 under the. Depreciation is maximized by applying the 179 expense against 7-year rather than 5- year property and in this case depreciation is maximized by applying the 179 expense against the machinery. 5445 under the half-year convention for personal property calculated as follows.

At the beginning of the year Poplock began a calendar-year dog boarding business called Griffs Palace. 5445 under the half - year convention for personal property calculated as follows. What is Poplocks year 2 depreciation expense for each asset.

Poplocks year 1 depriciation deduction for each asset is as follows- Assets Purchase date Quarter Recovery period A Cost B Depriciation Ist year Rate of depriciation Computer Equipment 323 Ist 5yrs 5000 1. Use MACRS Table 1 Table 2 Table 3. After four years its salvage value is 300.

Solved Required Information The Following Information Chegg Com

Solved Required Information Problem 10 46 Lo 10 2 The Chegg Com

At The Beginning Of The Current Year Poplock Began A Chegg Com

Solved The Following Information Applies To The Questions Chegg Com

Solved Required Information The Following Information Chegg Com

Solved Required Information The Following Information Chegg Com

Answered A What Is Poplock S Year 1 Bartleby

Solved 46 Lo 2 At The Beginning Of The Year Poplock Began Chegg Com

Solved At The Beginning Of The Current Year Poplock Began A Chegg Com

Solved Required Information The Following Information Chegg Com

Solved At The Beginning Of The Current Year Poplock Began A Chegg Com

Solved Required Information The Following Information Chegg Com

Solved At The Beginning Of The Current Year Poplock Began A Chegg Com

Solved Required Information The Following Information Chegg Com

Solved At The Beginning Of The Current Year Poplock Began A Chegg Com

Solved Required Information Problem 10 46 Lo 10 2 The Chegg Com

Solved Required Information The Following Information Chegg Com

Solved Required Information The Following Information Chegg Com

Solved The Following Information Applies To The Questions Chegg Com

Comments

Post a Comment